Wells Fargo Affidavit of Domicile free printable template

Show details

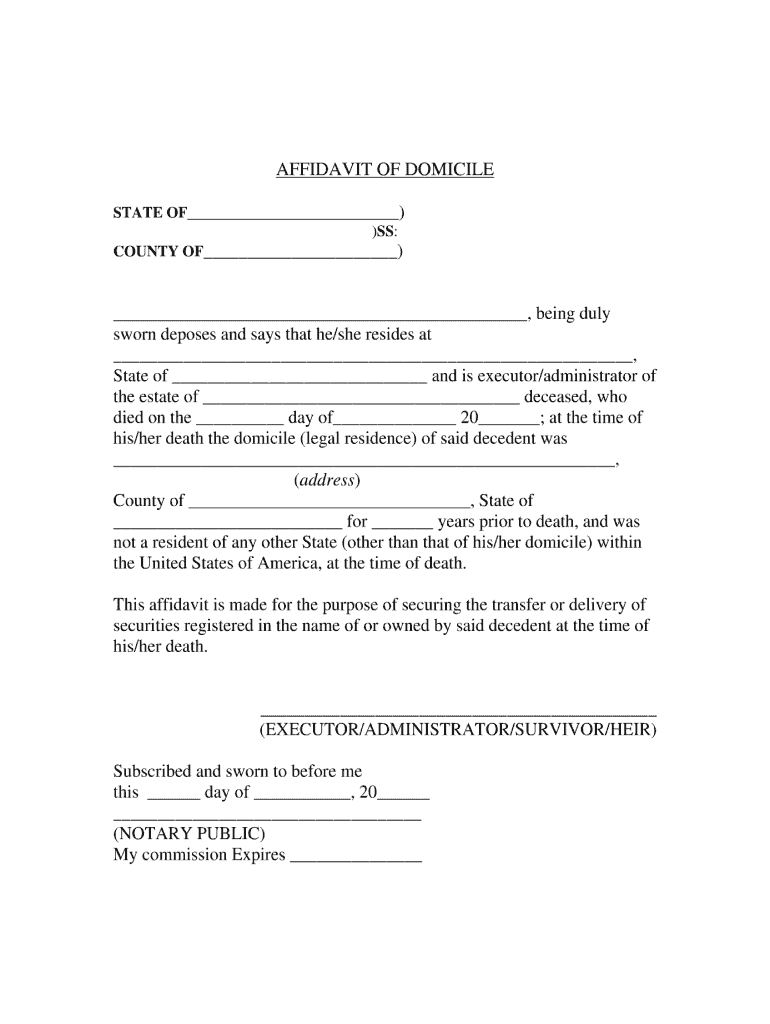

AFFIDAVIT OF DOMICILE STATE OF))SS: COUNTY OF), being duly sworn deposes and says that he/she resides at, State of and is executor/administrator of the estate of deceased, who died on the day of 20

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign affidavit of domicile form

Edit your affidavit of domicile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

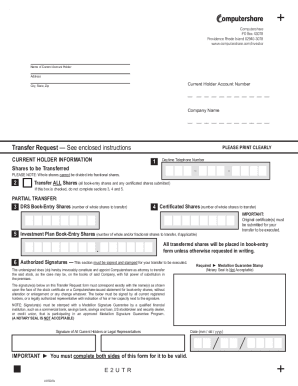

Editing domicile affidavit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit affidavit of domicile pdf form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

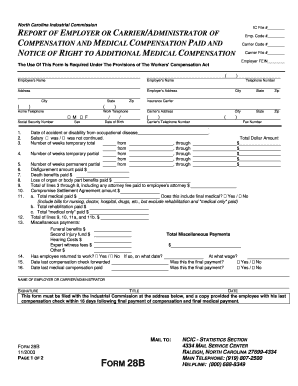

How to fill out domicile printable form blank

How to fill out Wells Fargo Affidavit of Domicile

01

Obtain the Wells Fargo Affidavit of Domicile form from a Wells Fargo branch or their website.

02

Begin filling out the form by entering your personal information, including your name, address, and contact information.

03

Provide details about the deceased individual, including their name and the date of death.

04

Include information regarding the property/assets held by the deceased that require the affidavit.

05

Sign and date the affidavit in the designated area, ensuring witnesses, if required, also sign.

06

Submit the completed affidavit to Wells Fargo along with any necessary documentation, such as a death certificate.

Who needs Wells Fargo Affidavit of Domicile?

01

Individuals managing the estate of a deceased person who had accounts or assets with Wells Fargo.

02

Beneficiaries or heirs who need to prove the domicile of the deceased for legal or financial proceedings.

03

Legal representatives, such as executors or administrators of the estate, who are settling an estate that includes Wells Fargo assets.

Fill

affidavit domicile printable

: Try Risk Free

People Also Ask about affidavit of domicile form pdf

What does an affidavit of heirship do in Texas?

An affidavit of heirship is a document used to give property to the heirs of a person who has died. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.

How do I file a declaration of domicile in Florida?

You may download a domicile form or obtain one at any Clerk of the Circuit Court & Comptroller location. Bring or mail the form to a Clerk's office location to be recorded. You must bring some form of legal identification if you need your document notarized.

What is the statement or affidavit of residence?

A proof of residency letter, or 'affidavit of residence', is a sworn statement that a person resides at a specific address. This is often required to prove state residency.

What is proof of domicile in Mississippi?

Utility bills, official government documents, property tax statements (and more!) can all be used as proof of residency in Mississippi. To apply for a Mississippi driver's license, you must provide proof of permanent Mississippi residency to the Driver Service Bureau.

What does descendants domicile mean?

A decedent can be “domiciled” in the U.S. for estate and gift tax purposes if they lived in the U.S. and had no present intention of leaving.

Is affidavit of domicile required in Texas?

The applicant must use this affidavit to support their claim of residency or being domiciled in Texas. This form and any proof submitted do not guarantee the issuance of a Texas driver license or identification card.

What are the requirements for an affidavit of heirship in Texas?

When using an affidavit of heirship in Texas, the witnesses must swear to the following conditions: They knew the decedent. The decedent did not owe any debts. The true identity of the family members and heirs.

How do I fill out a declaration of domicile in Florida?

Completing the Form Line 1 - Fill in the last address you lived at before you moved to the state of Florida/or if within Florida, your previous address. Line 2 - Fill in the date you moved to Florida. Line 3 - Fill in your current address. Line 4 - Your signature. Line 5 - Clearly and legibly PRINT the name that you signed.

What is an affidavit of domicile in Texas?

An affidavit of domicile is a legal document that legally verifies where a decedent lives. After person's death, it may be necessary for relatives to establish the decedent's primary place of residence for inheritance and the probate process.

What do you mean by affidavit?

An affidavit is a sworn statement put in writing. When you use an affidavit, you're claiming that the information within the document is true and correct to the best of your knowledge. Like taking an oath in court, an affidavit is only valid when you make it voluntarily and without any coercion.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

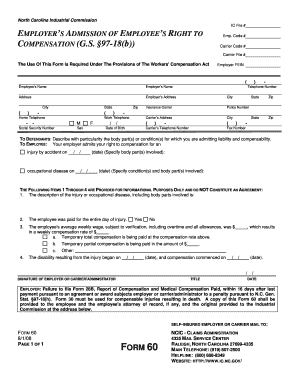

How do I make edits in blank affidavit of domicile form without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your how to fill out an affidavit of domicile, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit affidavit for domicile certificate on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share affidavit for domicile from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit domicile affidavit online on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share edit your how to affidavit of domicile or blackout data for discretion add comments on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

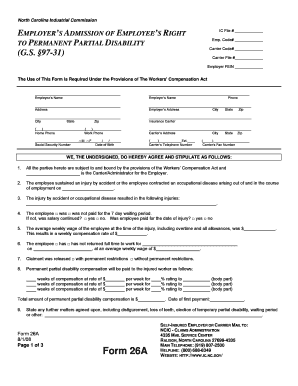

What is Wells Fargo Affidavit of Domicile?

The Wells Fargo Affidavit of Domicile is a legal document that certifies an individual's primary residence, typically used for estate settlement or to verify the identity of beneficiaries.

Who is required to file Wells Fargo Affidavit of Domicile?

The Affidavit of Domicile is usually required to be filed by the executor or administrator of an estate or by beneficiaries who need to confirm the decedent's residence for legal or financial purposes.

How to fill out Wells Fargo Affidavit of Domicile?

To fill out the Affidavit, individuals must provide details including the decedent's name, address, date of death, and a statement affirming that the given information is true.

What is the purpose of Wells Fargo Affidavit of Domicile?

The purpose of the Affidavit of Domicile is to establish the legal residency of the deceased person, which can influence estate taxes, the legitimacy of beneficiaries, and the handling of assets.

What information must be reported on Wells Fargo Affidavit of Domicile?

The information that must be reported includes the decedent's full name, primary residence address, date of death, and a swearing statement affirming the truth of the reported information.

Fill out your Wells Fargo Affidavit of Domicile online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Affidavit Of Domicile is not the form you're looking for?Search for another form here.

Keywords relevant to affidavit of domicile example

Related to domicile letter

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.